Have you ever paused to wonder why Bitcoin mining, despite its soaring difficulty and volatility, continues to lure hordes of miners worldwide? The answer lies in **the intricate economics and razor-thin margins that define the mining landscape**—a crucible where technology, energy costs, and market forces collide. Recent insights from the 2025 Cambridge Centre for Alternative Finance unveil that **over 74% of global Bitcoin mining operations are profitable only due to advancements in hardware efficiency and regional energy arbitrage**.

To decode this, let’s first untangle the core components of Bitcoin mining economics. Mining is fundamentally a **cost competition game**, where each participant vies to solve cryptographic puzzles with limited resources. The primary cost drivers are hardware expenditure, electricity consumption, operational overhead, and sometimes, hosting fees for mining rigs.

The theory is straightforward: your hashing power multiplied by uptime versus your total cost defines your profitability horizon. But in practice, miners face an ever-escalating **difficulty adjustment mechanism** that demands constant upgrades and strategic energy sourcing. Take the case of Marathon Digital Holdings, who pivoted to Texas in late 2024, capitalizing on sub-3-cent per kWh power deals that flipped their ROI metrics positively amidst market dips.

Plugging into this, the mining rig—a mix of ASIC miners like Bitmain’s Antminer S19 XP or MicroBT’s Whatsminer M50S—plays a starring role. By 2025 standards, these beasts churn out about 140 TH/s while consuming roughly 3,000 watts. A miner’s profitability becomes highly sensitive to watt-to-hash ratios—colloquially dubbed “joules per terahash.” Miners boasting figures below 21 J/TH enjoy tangible headroom against rising electricity prices.

Consider Bitfury’s 2025 in-house developed rig clocking in at an industry-best 18 J/TH. Its deployment in hydro-rich regions like Quebec showcases a prime example of matching cutting-edge hardware to low-cost renewable energy, amplifying miner margins and sustainability—a narrative increasingly favored by institutional stakeholders and climate-conscious investors.

Shifting gears, the operational expenses (OpEx) cluster around cooling infrastructure, maintenance, and staffing. Hosting services—where miners outsource their rigs to specialized data centers—have ballooned since 2023, fueled by an explosion in demand for **“plug-and-play” mining farms.** Genesis Mining, a pioneer in this domain, reported a 45% increase in hosted hash rate in early 2025 alone, leveraging strategic locations with lower grid stress and grid-friendly power mixes.

Such economies of scale allow smaller investors to ride shotgun on mining ventures without navigating the labyrinth of rig management and power contracts. However, hosting inevitably introduces additional fees, which miners must meticulously factor into their break-even calculus. For instance, at an average hosting fee of $0.03/kWh, the profit margin difference for a mid-tier miner can swing by 10-15%.

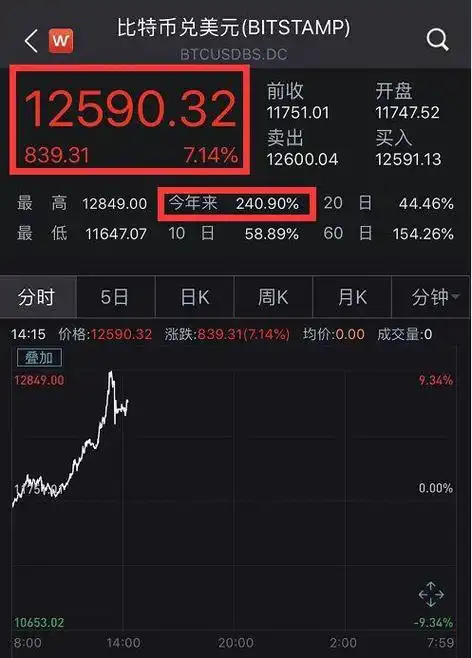

At the intersection of technology and economics sits the volatile exchange rate—a wild card in the mining equation. Bitcoin’s price gyrations directly impact miners’ revenue in fiat terms. Researchers at the International Crypto Economic Forum (ICEF) reported that mining profitability showed a high correlation coefficient (>0.85) with Bitcoin’s USD price fluctuations throughout Q1 2025, amplifying risk profiles and investment cycles.

Adding more spice to the pot, mining difficulty adjustments often lag price surges, creating transient profit windfalls or “difficulty dips.” Experienced miners exploit these windows, turbocharging their hashing power investments to maximize gains before the difficulty clamps down again. This cat-and-mouse game keeps the mining economy in perpetual flux, fostering opportunistic buying and selling of mining rigs and hashing power.

While Bitcoin mining’s economics are the marquee act, it’s worth noting the contrasting math of altcoins like Ethereum and Dogecoin. Ethereum’s transition to proof-of-stake trimmed mining demand sharply, morphing into staking revenues instead. Dogecoin miners often piggyback on Litecoin rigs due to merged mining compatibility, earning reduced but stable returns. Such nuances push miners to diversify portfolios or pivot strategies constantly.

Ultimately, the crux of Bitcoin mining economics in 2025 boils down to mastering **the balance between cutting-edge hardware efficiency, rock-bottom energy costs, savvy hosting arrangements, and acute market timing**. This complex ballet separates the winners from the pack in an ecosystem that’s as unforgiving as it is lucrative.

Author Introduction

Andreas M. Antonopoulos

Renowned Bitcoin advocate, author of “Mastering Bitcoin” and “The Internet of Money.”

Certified in Blockchain Technology from the University of Nicosia.

Over a decade of experience as a speaker, educator, and consultant in cryptocurrency and decentralized systems.

Frequent contributor to the Cambridge Centre for Alternative Finance reports and industry-leading blockchain conferences worldwide.

Leave a Reply to thomasallen Cancel reply